Market Updates

Digital Euros and Dollars Are Scaling, Klarna and Visa Moving onto Internet-Native Rails

Digital euros and dollars are scaling, and major consumer platforms and financial institutions are adopting them as core infrastructure.

Steven Figura

Dec 18, 2025

3min

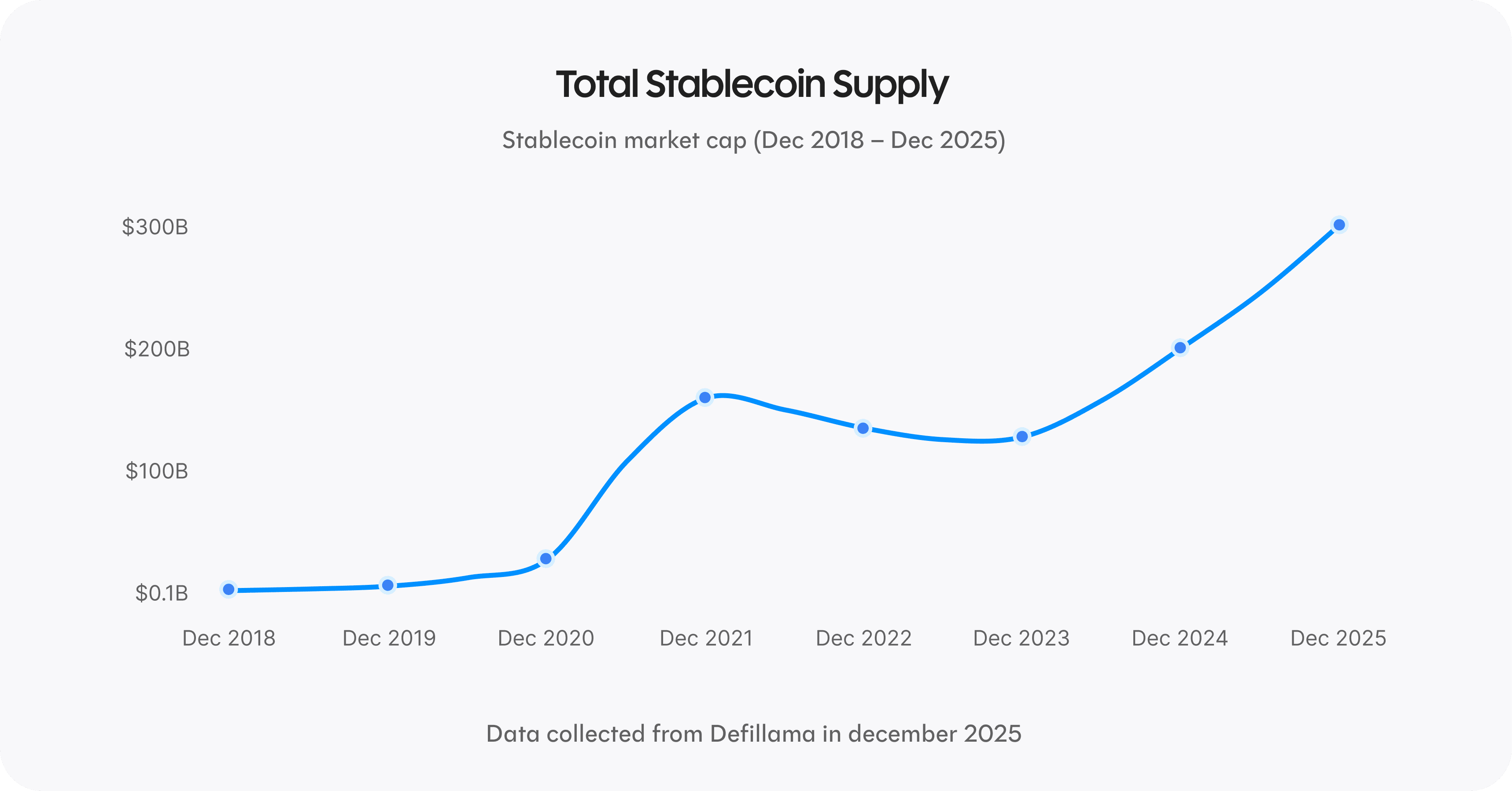

The amount of digital euros and dollars in circulation continues to increase.

Recent market data shows:

Total stablecoin supply at approximately $310 billion

~51% growth year over year

~13% increase over the last 90 days

As volumes increase, these digital forms of cash become more liquid and more deeply embedded in financial systems.

For savers, this matters because savings products built on these rails operate continuously and globally, without being constrained by banking hours or fragmented systems.

Savings rates across the market

Product / Market | EUR savings rate | USD savings rate |

|---|---|---|

Traditional savings account** | 0.75% | 0.01% |

Revolut savings* | 1.18% | 2.43% |

Open money markets (avg.) | 1.9% | 5.3% |

Rebind | 3.45% | 4.52% |

Rebind Plus | 5.31% | 7.20% |

* in-app promotion on 22.12.2025 in Standard tier / ** reference as of 22.12.2025: JPM Chase for USD & Commerzbank for EUR

What this shows right now

Over 20 years, saving with Rebind can earn 5x more than a traditional savings account. On a 100k€ balance, that’s at least roughly 81k€ more in earnings that would otherwise be left behind.

Major consumer platforms and financial institutions are moving onto internet-native rails

Over the past months, a clear pattern has emerged across the financial ecosystem. Consumer platforms, payment networks, and banks are increasingly moving core financial activity onto digital euros and dollars.

Large consumer fintechs are integrating digital cash directly into everyday banking experiences. Revolut now enables users to convert between fiat and digital dollars at a one-to-one rate and spend them directly via card, something that Rebind has implemented for a while now already.

A similar shift can be seen at Klarna, which has confirmed plans to launch its own fully backed USD stablecoin. The focus here is on improving how payments and settlements work across borders, using more efficient infrastructure.

At the payment network level, Visa and Mastercard have expanded support for settling transactions using regulated digital euros and dollars. Settlement is one of the most conservative layers of the financial system, and changes here tend to signal long-term confidence rather than experimentation. Rebind’s Visa debit card benefits from this.

Digital cash is also becoming part of income flows. YouTube, in partnership with PayPal, now allows creators to receive payouts in digital dollars. For many users, this is their first interaction with internet-native money, without needing to manage or understand underlying technology.

Traditional financial institutions are moving in the same direction. JPMorgan has launched tokenized money market funds on public blockchains, allowing familiar financial products to settle on modern rails. In Europe, major banks and payment networks are advancing euro-denominated digital cash initiatives under the MiCA framework, aligning regulation and infrastructure around the same systems.

Taken together, these developments show how financial infrastructure is evolving beneath the surface. What once required bespoke integrations and technical expertise is becoming part of standard financial operations.

For Rebind users, this offers quiet confirmation. Saving on internet-native rails already aligns with the direction consumer platforms, payment networks, and banks are moving toward.

Putting it together

Digital euros and dollars are scaling quickly. Open money markets continue to offer savings rates that traditional systems struggle to match. At the same time, consumer platforms, payment networks, and banks are upgrading the infrastructure that moves money globally.

Rebind users are already saving on these modern rails. What is now being adopted by companies like Klarna, YouTube, Visa, and JPMorgan is the same underlying infrastructure that powers Rebind today.

This places Rebind users at the forefront of a broader shift in how money works. Not by chasing trends, but by using financial infrastructure that is increasingly becoming the new standard.

This market update is provided for informational purposes only and does not constitute financial advice.